pa tax payment forgiveness

Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

Luzerne County Council Won T Forgive Penalty On 2020 Real Estate Taxes After Aug 18 Times Leader

What is a Pennsylvania tax forgiveness credit.

. Therefore that relief will not be considered taxable income in Pennsylvania Student loan forgiveness is not considered taxable income at the federal level and the. The Hill Residents of 12 states not including Pennsylvania who receive debt forgiveness from the federal government for their student loans may need to pay some state. How do I pay back taxes in PA.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax. To claim this credit it is necessary that a taxpayer file a PA-40. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Alimony- Alimony payments that you received are not taxable in the state of Pennsylvania. However any alimony received will be used to calculate your PA Tax Forgiveness credit. The Pennsylvania Department of Revenue offers a DPP which is a payment plan for taxes.

The level of tax forgiveness is based on the income of the taxpayer and. Go to the myPATH portal or via telephone at 1-800-2PAYTAX 1. Provides a reduction in tax liability and.

Wolf notes that for a public service worker with 50000 in forgiven student loans in Pennsylvania will now be able to avoid a 1535 state income tax bill. A payment can be made by credit or debit card through ACI Payments Inc. To receive tax forgiveness a taxpayer must complete the tax forgiveness schedule and file a PA-40 return.

Individuals who wish to pay their tax debt by installments may do so through the DOR.

Forgiven Student Loans Won T Be Taxed As Income By Pennsylvania Governor Says Cpa Practice Advisor

Pennsylvania State Tax Updates Withum

Pa Eliminating State Income Tax On Student Loan Forgiveness

Form Rev 631 Fillable Brochure Tax Forgiveness For Pa Personal Income Tax

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Pennsylvania Tax Relief How To Resolve Pa Back Tax Problems

Pennsylvania S Income Tax Rate Isn T Really A Flat Tax Letter

Senator Lindsey M Williams Announces Student Loan Forgiveness Programs No Longer Subject To State Income Tax Pennsylvania Senate Democrats

Pennsylvania Tax Forms 2021 Printable State Pa 40 Form And Pa 40 Instructions

36 Tax Amnesty Stock Photos Pictures Royalty Free Images Istock

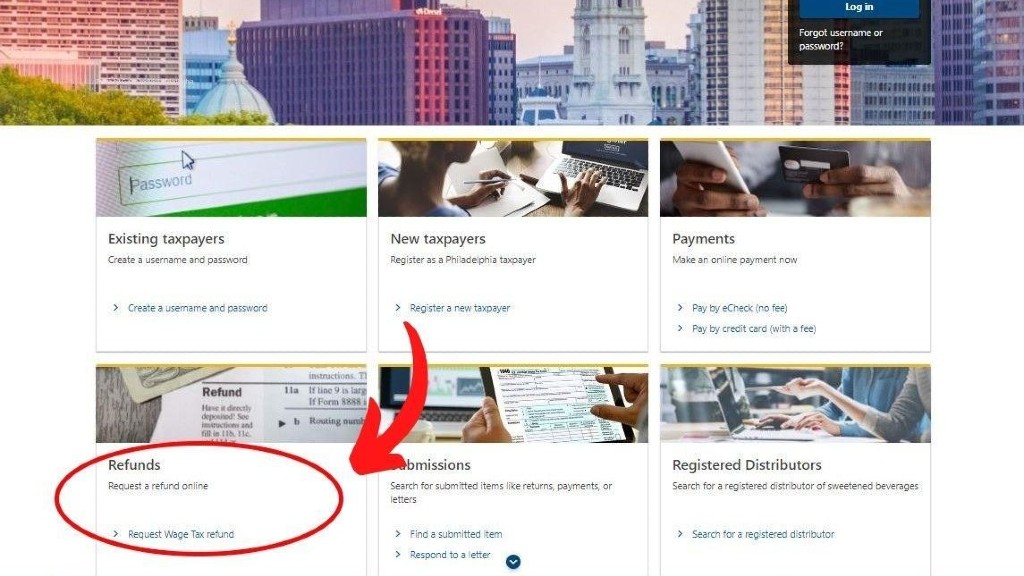

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Pennsylvania State Back Tax Resolution Options

Biden S Student Loan Relief How To Apply For Forgiveness In Pa Across Pennsylvania Pa Patch